what items are exempt from sales tax in tennessee

Several examples of items that are considered to be exempt from Tennessee sales tax are medical supplies certain groceries and food items and items which are used in the. The Tennessee state sales tax rate is 7 and the.

Sales Tax Exemption How To Avoid Sales Tax In Trucking Youtube Trucks Tax Exemption Tax

2022 Tennessee state sales tax.

. Learn about new tax laws and industry changes. On top of the state sales tax there may be one or more local sales taxes as well. Clothing is defined as human wearing apparel suitable for general use.

Ad The Avalara report is available. Items Not Taxable at the 400 Food Rate 25. Generally contractors and subcontractors are users and consumers and must pay tax on the purchase price of materials supplies and taxable services that are used in the.

The used car dealership must also title the new car in. Here is a sample list of exemptions. STH-8 - Types of Clothing Items that Qualify for Sales Tax Holiday Exemption.

During the holiday the following items are exempt from sales and use tax. Tennessee department of revenue additional information or instructions. And discover some of the long-term effects recent events are having on tax compliance.

Tax Exempt Items for 2020. This page describes the taxability of. 43 rows In the state of Tennessee sales tax is legally required to be collected from all tangible.

18 rows In Tennessee certain items may be exempt from the sales tax to all consumers not just. Ad The Avalara report is available. While Tennessees sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Clothing with a price of 100 or less per item school and school art supplies with a price of 100 or. Customers in the previous 12-month period are required to collect and remit Tennessee sales tax. What is exempt from Tennessee Sales Tax.

Are Occasional Sales subject to sales tax. Effective October 1 2020 Page 23. Military car sales tax exemption tennessee.

SUT-33 - Sale for Resale - Out-of-State Resale Certificates. What is Exempt From Sales Tax In Tennessee. Mining Photography Printing Digital Products Contractors Water Pollution Control Prescription Eyewear.

Tennessee Department of Revenue July 2020. While Tennessees sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales. Municipal governments in Tennessee are also allowed to collect a local-option sales tax that ranges from 15 to 275 across the state with an average local tax of 2614 for a total of.

If a business qualifies as a manufacturer sales made from the qualified location of items not manufactured at that location but incidental to the businesss manufacturing sales. Exempt if 100 or less per item. Information for farmers timber harvesters nursery operators and dealers from whom they buy to understand the scope of exemptions and reduced rates the purchases.

Exact tax amount may vary for different items. What is the 2022 Tennessee Sales Tax Rate. Some exemptions are based on the product purchased.

Up to 7 cash back The Walmart Tax-Exemption Program WTEP is our tool to allow an exempt customer to be recognized for automatic removal of taxes during checkout of. A customer living in Clarksville finds Steves eBay page and purchases a 350 pair of headphones. And discover some of the long-term effects recent events are having on tax compliance.

The Tennessee sales tax exemption for manufacturing also. Composition Books School supply. The state of Tennessee levies a 7 state sales tax on the retail sale lease or rental of most goods and some services.

Clay School art supplies are exempt. The tax-free holiday weekend focusing on clothing and other back-to-school items begins at. Tennessee first adopted a general state sales tax in 1947 and since that time the rate has risen to 7 percent.

This article has been updated to reflect the repeal of Sales and Use Tax Rule 96 and is effective January 10 2022. When calculating the sales tax for this purchase Steve applies the 7000. Learn about new tax laws and industry changes.

For example gasoline textbooks school meals and a number of healthcare products are not subject to the. Since the state of Tennessee started collecting a sales tax in 1947 certain items have been considered tax-exempt because these items go into producing items which will be taxed by the.

Which States Have No Sales Tax Quora

Sales Tax On Grocery Items Taxjar

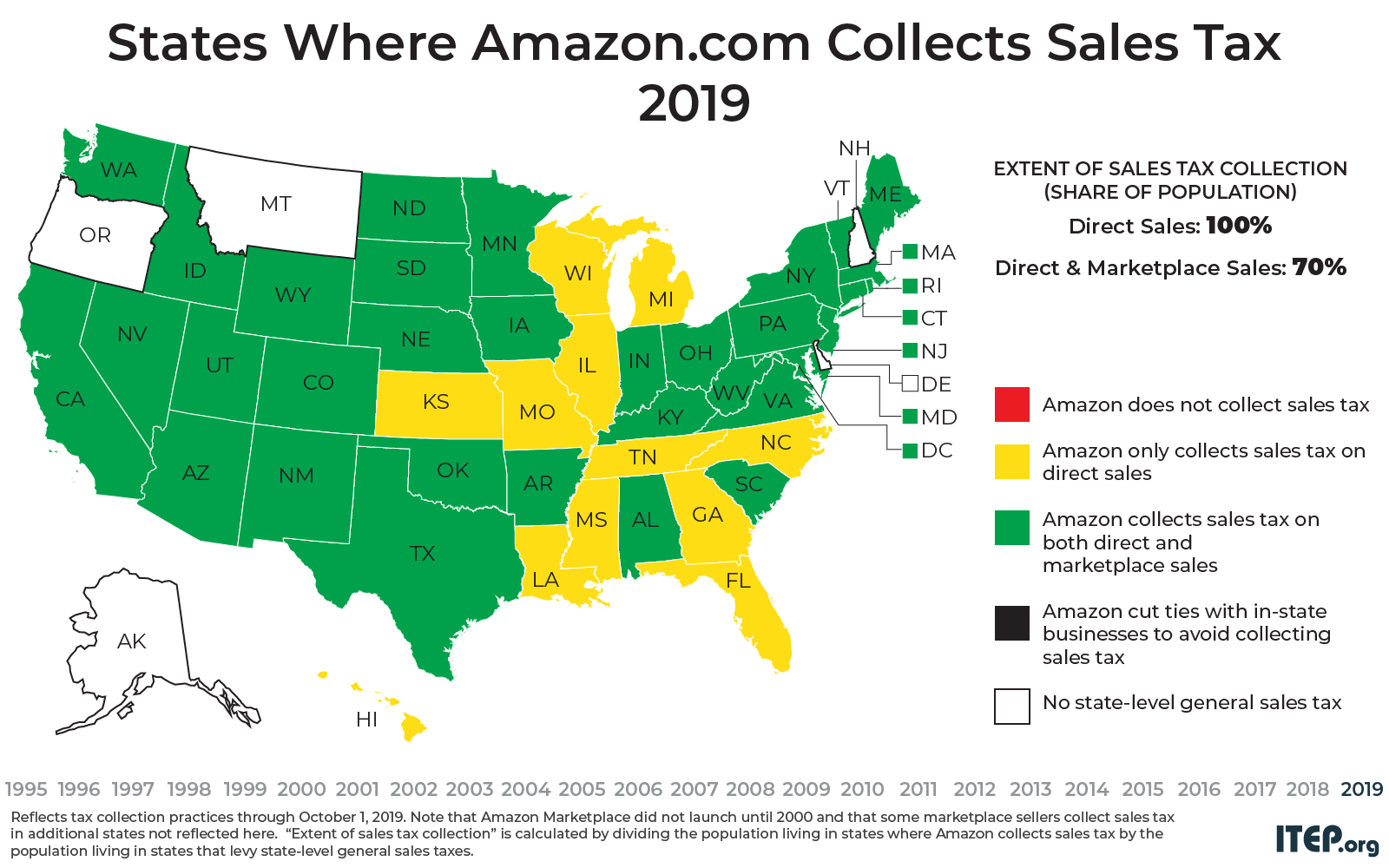

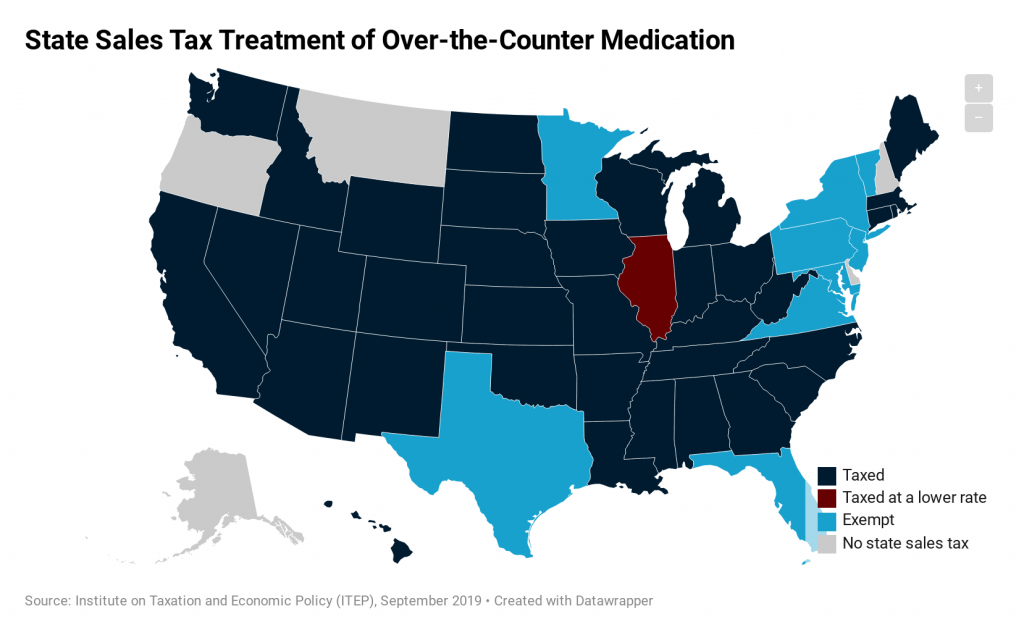

How Do State Tax Sales Of Over The Counter Medication Itep

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

What Is A Sales Tax Exemption Certificate And How Do I Get One

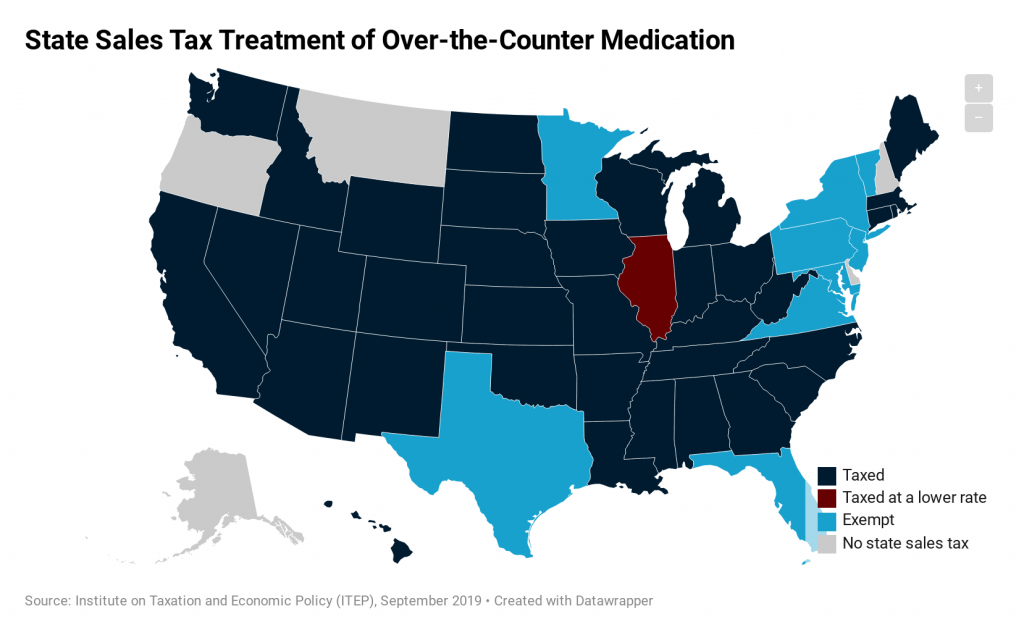

Sales Tax And Tax Exemption Newegg Knowledge Base

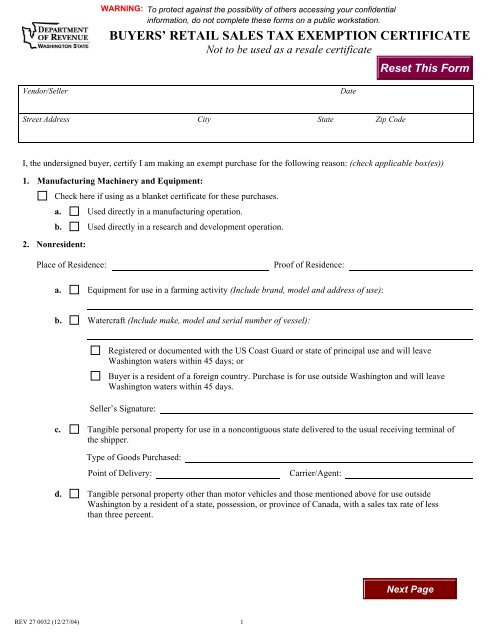

Buyers Retail Sales Tax Exemption Certificate

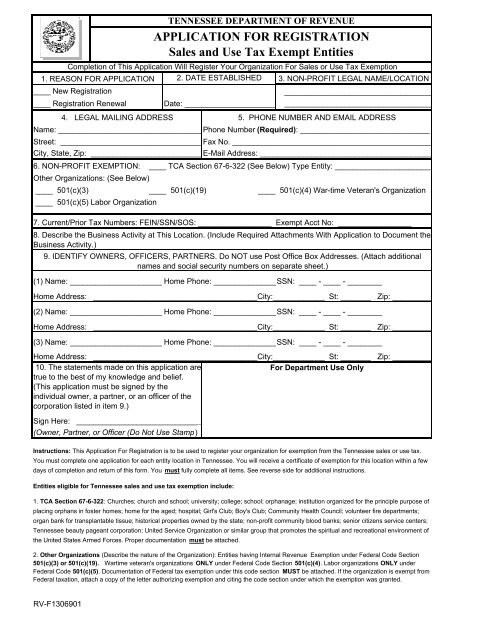

Tennessee Non Profit Sales Tax Exemption Certificate

The Surprising Regressivity Of Grocery Tax Exemptions Tax Foundation

List Of Tax Exempt Items Baby Receiving Blankets Emergency Kit Receiving Blankets

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

Sales Tax Exemption For Building Materials Used In State Construction Projects

Get And Sign Tennessee Sales Tax Exemption Form 2008 2022

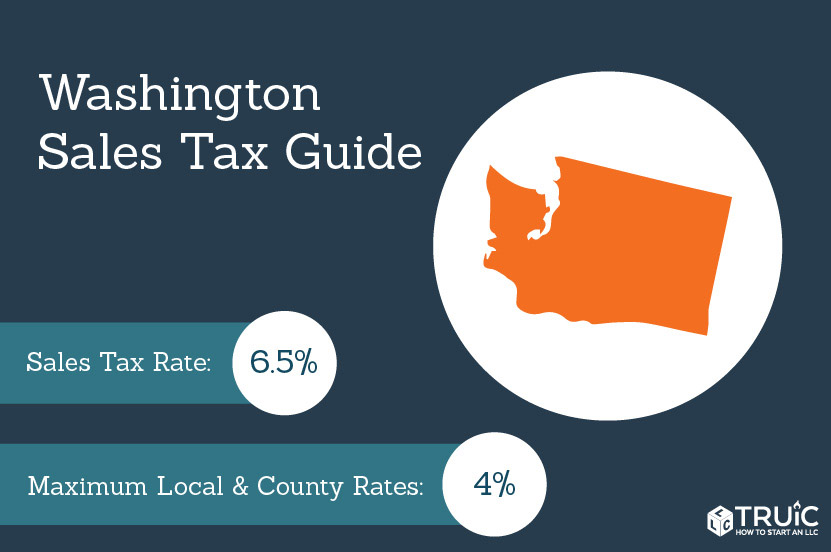

Washington Sales Tax Small Business Guide Truic

Sales Tax Exemptions Finance And Treasury

Sales Tax Rates And Exemptions For Agricultural Manufacturing And Download Scientific Diagram